Section 80C Deduction for FY 2019-20. 1 Pay income tax via FPX Services.

Effects Of Income Tax Changes On Economic Growth

Estimate your take home pay after income tax in Malaysia with our easy to use and up-to-date 2022 salary calculator.

. Malaysia adopts a territorial scope of taxation where a tax-resident is taxed on income derived from Malaysia and foreign-sourced income remitted to Malaysia. Section 87A as per the Fiscal Year 2017-18 provides taxpayers with an income tax rebate of Rs. 1 Australias income tax treaties are given the force of law by the International Tax Agreements Act 1953The Agreement between the Australian Commerce and Industry Office and the Taipei Economic and Cultural Office concerning the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income is a document of less than treaty status.

The existing standard rate for GST effective from 1 April 2015 is 6. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Short title and commencement 2.

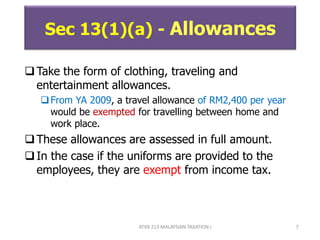

Such employee must receive their employment income prescribed under Section 13 of the Income Tax Act 1967. 3 50000 during the Fiscal Year 2017-18 then that individual cannot claim tax deduction under section 87A. Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3.

A reporting entity must first determine whether the affiliated members are considered a single tax-paying component. Accounting Standards Codification ASC 740 Income Taxes addresses how companies should account for and report the effects of taxes based on income. Or b in any other case shall be deemed to be salary or wages income taxable at the rate declared by Section 13 of the Income Tax Salary or Wages Tax Rates Act 1979.

The starting salary of the SSC CGL Income Tax Inspector and Income Tax Officer is somewhere around 44900 INR along with a grade pay that ranges somewhere between 4000-5500 INR. Section 115BAB of Income Tax Act 1961 deals with Tax on income of new manufacturing domestic companies and is inserted with effect from the 1st day of April 2020. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Section I TIN Description Malaysian Income Tax Number ITN or functional equivalent In Malaysia both individuals and entities who are registered taxpayers with the Inland Revenue Board of Malaysia IRBM are assigned with a Tax Identification Number TIN known as Nombor Cukai Pendapatan or Income Tax Number ITN. Prescribed incometax authority under second proviso to clause i of subsection 1 of section 142. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. Such employee must serve under the same employer for a period of 12 months in a calendar year ie. From 70000 to 100000.

According to the Global Competitiveness Report 2021 the Malaysian economy is the 25th most competitive country economy in the world. Non-chargeability to tax in respect of offshore business activity 3 C. Agreement Between The Government of Malaysia and The Government of the Republic of India for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income.

Penalty Payment For Section 25. Let us understand the salary package and the incentives earned by an Income Tax. My support is about THB 30000 per month from.

MTD of such employee must be made under the Income Tax Deduction from Remuneration Rules 1994. Income Tax Deductions under Section 80. The 2018 labour productivity of Malaysia was measured at Int55360 per worker the third highest in ASEAN.

This also means that if the total income of a taxpayer is above Rs. I have closed my tax file in Malaysia when I relocated to Thailand. Tax Settlement - Employer.

Article answers few question related to Section 115BAB of Income Tax Act 1961. Earn MS Coin when you trade with MST28. Malaysia Income Tax Brackets and Other Information.

Find out how much Thailand income tax youll pay when working or retiring here and the deductions and allowances you can claim back. The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia. Charge of income tax 3 A.

Section 80U Deduction in Income Tax. However foreign-sourced income of all Malaysian tax residents except for the following subject to conditions to be announced which is received in Malaysia is no longer be exempted. From 100000 to 250000.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967. Try MST28 trading from Mercury Securities with rates as low as 005. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000.

Jan 1 Dec 31. Section 80D Deductions for FY 2019-20. Shall be deemed to be salary or wages income taxable at the rate declared by Section 12 of the Income Tax Salary or Wages Tax Rates Act 1979.

While the scope of ASC 740 appears to be self-explanatory the unique characteristics of different tax regimes across the United States and the world can make it difficult to determine whether a particular tax is. See the section below of a definition on resident. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

2500 provided the total income is more than Rs. Tax Offences And. Get FREE real time quotes on our website App.

Income Tax Section 80 HRA. Here are the many ways you can pay for your personal income tax in Malaysia. Income Tax Rebate in India.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. As per the grade you are selected for there can be a mild variation in the salary. The economy of Malaysia is the third largest in Southeast Asia and the 34th largest in the world in terms of GDP.

We believe that the determining factors for this classification are 1 whether the taxing authorities can pursue one subsidiary for the others income tax liabilities and 2 whether the election allows for offset in all cases eg whether it allows carryback or. Application for extension of time for. Try MST28 trading from Mercury Securities with rates as low as 005.

Check out our detail section.

How Much Do You Need To Save For Your Children S Higher Education Created In Free Piktochart Infogra Educational Infographic Childrens Education Education

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

/financialstatements-aae574dcdec44b3c8113ec436a2e5c2a.png)

Financial Statements List Of Types And How To Read Them

Taxation Assignment Help Assignment Help Australia Uk Usa Malaysia 9 5 Page On All Writing Assignments Helpful Writing

How To Trade Inside Bar Candlestick Patterns Trading Charts Forex Trading Strategies Videos Bio Data For Marriage

Building Contractor Appointment Letter How To Create A Building Contractor Appointment Letter Download This Building C Lettering Letter Templates Templates

Pan Card Application In Qatar Cards Number Cards Application

Business Tax Deadline In 2022 For Small Businesses Shopify Philippines

House Rental Agreement Format Docxfind This Example Of Simple House Rent Agreement To Rental Agreement Templates Buying A Rental Property Room Rental Agreement

Income Tax Teeth Grinding Income Tax Tax Deductions Income Tax Return

House Rental Receipt Formats 11 Free Printable Word Excel Templates Receipt Template Free Receipt Template Rent

Third Party Accounting Services In Singapore Makes You Completely Tension Free Accounting Services Accounting Bookkeeping Services

Statement Of Account Templates 12 Free Docs Xlsx Pdf Statement Template Bank Statement Personal Financial Statement